Us Housing Market Statistics For 2024: What You Need To Know

The US housing market is a complex and ever-changing landscape, with a multitude of factors influencing its dynamics. From interest rates to economic conditions and demographics, understanding the current trends and forecasts for 2024 is crucial for both homebuyers and sellers.

In this comprehensive guide, we delve into the intricacies of the US housing market, providing insights into regional market analysis, housing affordability, and the potential impact on buyers and sellers. We also explore policy considerations and potential government interventions aimed at addressing challenges and improving stability in the housing market.

Current Market Trends

The US housing market continues to be a topic of interest for investors, homebuyers, and economists alike. As of early 2023, the market is experiencing a period of transition, with factors such as rising interest rates, inflation, and geopolitical uncertainty influencing market dynamics.

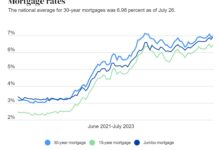

One of the most significant factors impacting the housing market is the Federal Reserve’s decision to raise interest rates. Higher interest rates make it more expensive for buyers to finance a mortgage, which can lead to a decrease in demand for housing and a slowdown in home price appreciation.

Economic Conditions

The overall economic conditions also play a crucial role in shaping the housing market. A strong economy with low unemployment and rising wages can boost consumer confidence and increase demand for housing. Conversely, an economic downturn can lead to job losses and decreased consumer spending, which can negatively impact the housing market.

Demographics

Demographic trends are another important factor to consider when analyzing the housing market. The aging population and the increasing number of millennials entering the housing market are expected to influence demand for different types of housing in the coming years.

Regional Market Analysis

The US housing market exhibits significant regional variations, influenced by factors such as local economies, population growth, and geographic features. Understanding these regional differences is crucial for investors and homebuyers.

Key Housing Market Metrics by Region

The table below provides a snapshot of key housing market metrics across different regions of the US, based on data from the National Association of Realtors (NAR).| Region | Median Home Price | Inventory Levels | Days on Market ||—|—|—|—|| Northeast | $450,000 | 1.8 months | 45 days || Midwest | $250,000 | 2.2 months | 60 days || South | $320,000 | 2.5 months | 50 days || West | $600,000 | 1.5 months | 30 days |

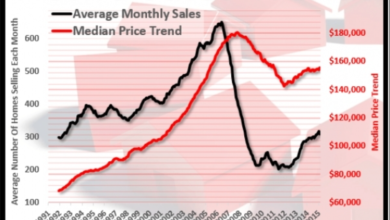

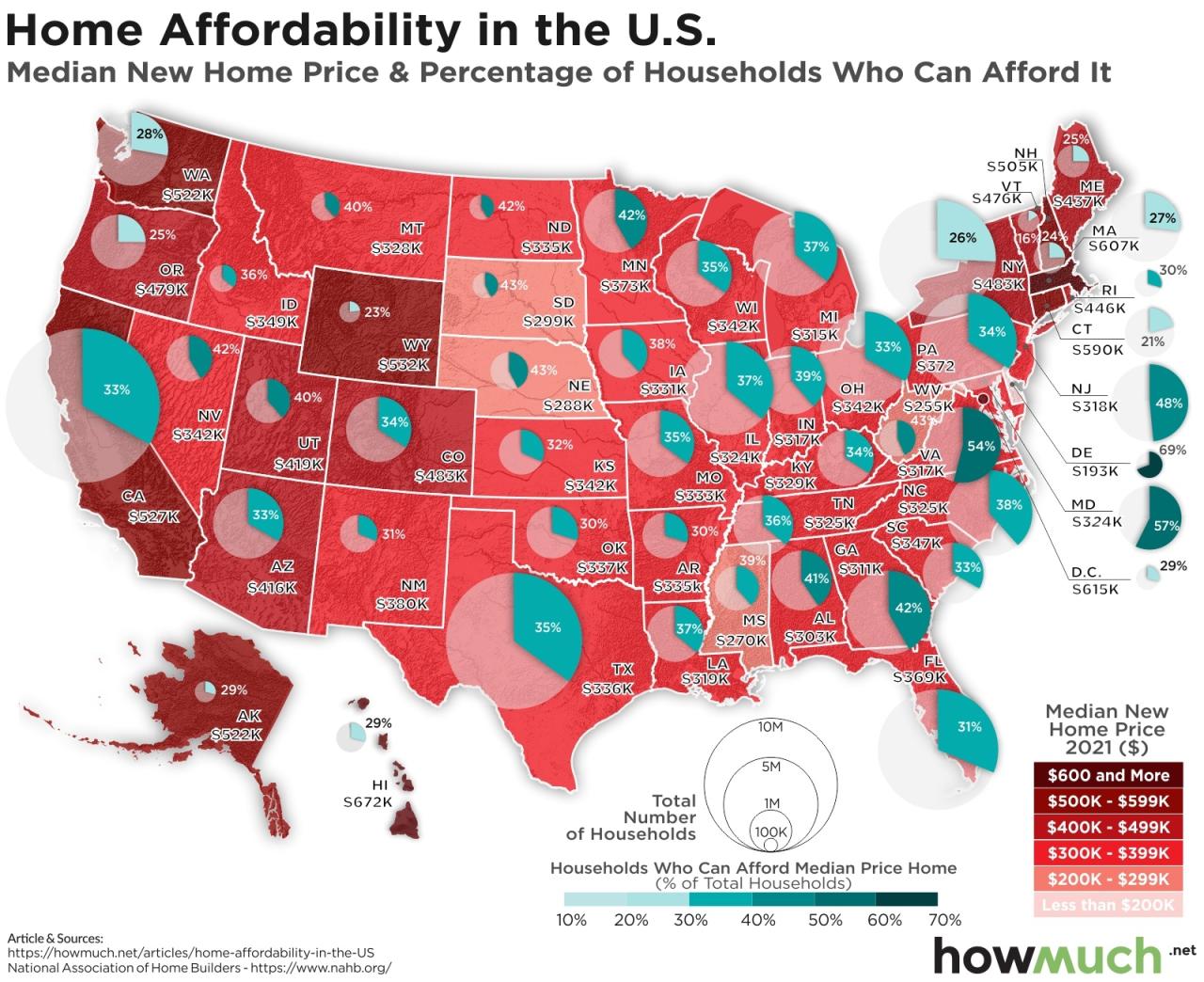

Housing Affordability

Affordability remains a significant concern in the US housing market, with rising home prices and stagnant wages making it challenging for many Americans to purchase a home. Affordability varies widely across different regions and cities, with some areas experiencing severe affordability constraints while others offer more accessible housing options.

Several factors contribute to affordability challenges. Rising home prices are a primary factor, driven by strong demand, low inventory, and increasing construction costs. Additionally, stagnant wages have made it difficult for incomes to keep pace with housing costs, further exacerbating affordability issues.

Regional Variations

Affordability varies significantly across different regions of the US. The most expensive housing markets are typically found in coastal areas and major metropolitan regions, such as California, New York, and Boston. In these areas, home prices are often multiple times the median household income, making it challenging for many residents to afford a home.

In contrast, more affordable housing markets can be found in the Midwest and Sun Belt regions. Cities like Indianapolis, Kansas City, and Dallas offer relatively affordable housing options, with home prices typically being more in line with median incomes.

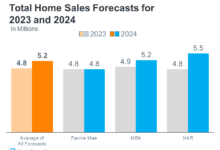

Forecasts and Projections

The US housing market is poised for continued growth in 2024, driven by strong economic indicators and favorable market trends. While the pace of appreciation may moderate from the record highs of recent years, home values are expected to remain elevated.

Several factors are contributing to the positive outlook for the housing market in 2024. These include:

Interest Rates

Interest rates are expected to remain relatively low in 2024, making mortgages more affordable for homebuyers. The Federal Reserve has indicated that it will continue to raise interest rates gradually, but at a slower pace than in 2023. This will help to keep mortgage rates below the long-term average.

Economic Growth

The US economy is expected to continue to grow in 2024, albeit at a slower pace than in recent years. This growth will create new jobs and increase incomes, which will support demand for housing.

Demographics

The millennial generation is now the largest generation in the United States, and they are beginning to form households and buy homes. This will continue to drive demand for housing in the coming years.

Potential Scenarios

Based on these factors, there are several potential scenarios for the US housing market in 2024:

- Scenario 1: Continued Strong GrowthIf the economy continues to grow and interest rates remain low, the housing market could continue to experience strong growth in 2024. Home prices could appreciate at a rate of 5% to 7%, and sales could remain elevated.

- Scenario 2: Moderate GrowthIf the economy slows down or interest rates rise faster than expected, the housing market could experience more moderate growth in 2024. Home prices could appreciate at a rate of 2% to 4%, and sales could decline slightly.

- Scenario 3: SlowdownIf the economy enters a recession or interest rates rise sharply, the housing market could experience a slowdown in 2024. Home prices could decline slightly, and sales could drop significantly.

The most likely scenario for the US housing market in 2024 is continued strong growth, with home prices appreciating at a rate of 5% to 7%. However, it is important to note that the housing market is always subject to change, and there is always the potential for a slowdown or even a recession.

Impact on Homebuyers and Sellers

The housing market outlook for 2024 presents both opportunities and challenges for homebuyers and sellers. Homebuyers may face increased competition and higher prices, while sellers may benefit from a seller’s market. Understanding the market dynamics is crucial for successful navigation in 2024.

Strategies for Homebuyers

*

-*Prepare Financially

Secure pre-approval for a mortgage to determine your budget and strengthen your negotiating position.

-

- -*Be Flexible Consider expanding your search criteria, such as location or home size, to increase your chances of finding a suitable property.

-*Act Quickly

In a competitive market, be prepared to make an offer quickly once you find a home that meets your needs.

-*Consider a Buyer’s Agent

A real estate agent can provide valuable insights, negotiate on your behalf, and streamline the homebuying process.

Strategies for Sellers

*

-*Price Strategically

Research comparable properties to determine an optimal listing price that attracts buyers while maximizing your return.

-

- -*Prepare Your Home Make necessary repairs and upgrades to enhance the property’s appeal and increase its value.

-*Market Effectively

Utilize multiple marketing channels, including online listings, social media, and open houses, to reach potential buyers.

-*Negotiate Skillfully

Be prepared to negotiate with buyers and consider their needs while protecting your interests.

-*Work with a Seller’s Agent

A real estate agent can provide guidance, handle negotiations, and ensure a smooth selling process.

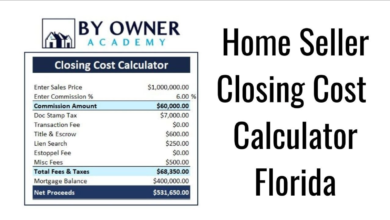

Policy Considerations

Addressing the challenges in the housing market requires careful consideration of various policy options. Governments play a crucial role in shaping the housing landscape through regulations, incentives, and interventions aimed at improving affordability and stability.

Policy considerations include:

Subsidies and Incentives

- Provide financial assistance to first-time homebuyers or low-income households through down payment assistance programs, tax credits, or closing cost subsidies.

- Offer tax breaks or incentives for developers to construct affordable housing units or rehabilitate existing ones.

Land Use and Zoning

- Review zoning regulations to encourage the development of high-density housing, mixed-use developments, and transit-oriented communities.

- Streamline the approval process for affordable housing projects to reduce delays and costs.

Mortgage Market Regulation

- Implement measures to prevent predatory lending practices and ensure responsible lending standards.

- Consider adjusting loan limits and underwriting guidelines to increase access to mortgages for first-time homebuyers and underserved communities.

Last Word

As we navigate the ever-evolving US housing market in 2024, it is essential to stay informed and make informed decisions. Whether you’re a first-time homebuyer, a seasoned investor, or simply curious about the state of the market, this guide equips you with the knowledge and insights you need to navigate the complexities and seize opportunities.

Helpful Answers

What are the key factors influencing the US housing market?

Interest rates, economic conditions, demographics, government policies, and natural disasters are among the key factors that shape the dynamics of the US housing market.

How does the US housing market compare across different regions?

The US housing market varies significantly across regions, with factors such as median home prices, inventory levels, and days on market differing substantially. Understanding these regional disparities is crucial for making informed decisions.

What are the challenges facing housing affordability in the US?

Rising home prices, stagnant wages, and a shortage of affordable housing units are among the primary challenges contributing to affordability issues in the US housing market.

What are the potential forecasts and projections for the US housing market in 2024?

Forecasts for the US housing market in 2024 consider economic indicators, market trends, and potential scenarios. These projections provide valuable insights into the direction of the market and help stakeholders make informed decisions.

How can homebuyers and sellers navigate the US housing market in 2024?

Understanding market trends, affordability challenges, and potential policy considerations empowers homebuyers and sellers to develop effective strategies for navigating the US housing market in 2024.