Understanding Typical Home Sales Commissions: What You Need To Know

Navigating the complexities of home sales commissions can be a daunting task. Understanding the different commission structures, factors that influence rates, and strategies for negotiation is crucial for both buyers and sellers to ensure a fair and successful transaction.

In this comprehensive guide, we will delve into the world of home sales commissions, providing you with the knowledge and tools you need to make informed decisions and maximize your financial outcomes.

Understanding Commission Structures

In home sales, real estate agents earn commissions for facilitating the sale of properties. The commission structure determines the amount of compensation an agent receives. Here are the common commission structures:

-

-

Flat Fee

-

A flat fee is a fixed amount agreed upon between the agent and the seller, regardless of the sale price. This structure provides the agent with a guaranteed income but may not incentivize them to maximize the sale price.

-

-

Percentage-Based Commission

-

Percentage-based commissions are calculated as a percentage of the sale price. This structure aligns the agent’s interests with the seller’s desire to obtain the highest possible price. However, it can lead to higher commissions for high-priced properties and lower commissions for lower-priced ones.

-

-

Tiered Commission

-

Tiered commissions involve different commission rates for different price ranges. This structure allows agents to earn higher commissions on higher-priced properties while still incentivizing them to sell lower-priced homes. However, it can be more complex to negotiate and administer.

Each commission structure has its advantages and disadvantages. The best choice depends on the specific circumstances of the sale and the preferences of the seller and agent.

Factors Influencing Commission Rates

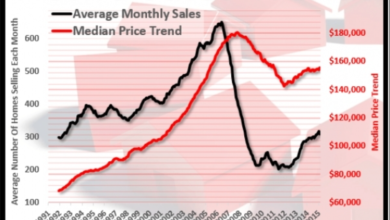

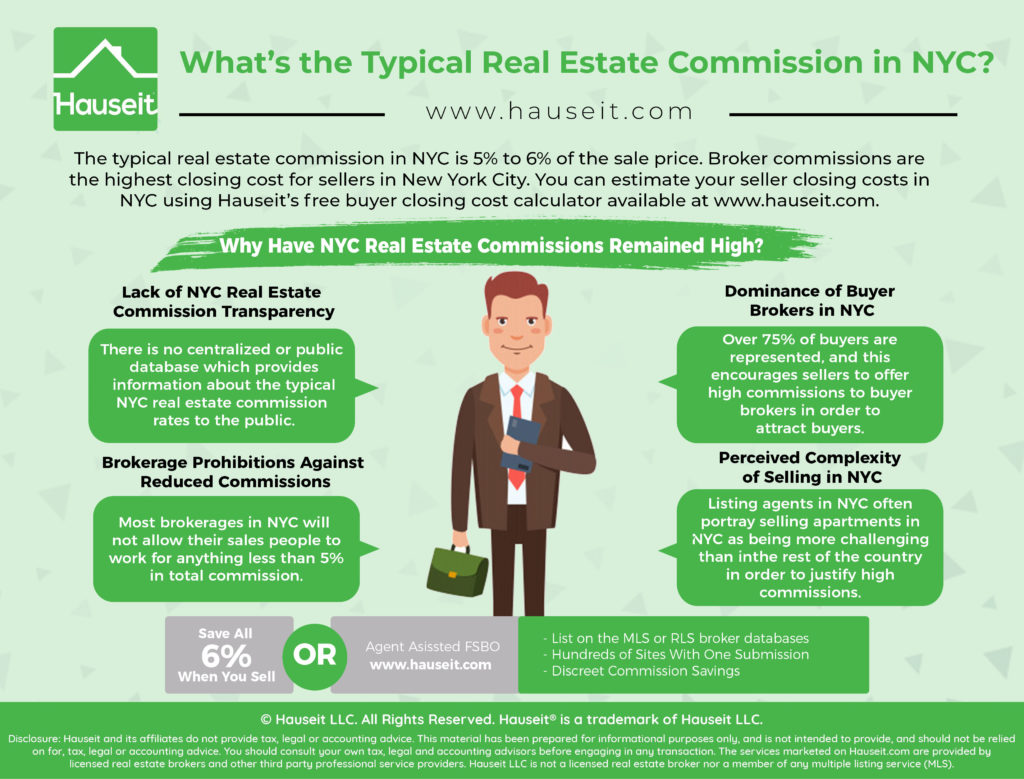

Commission rates for real estate agents are not set in stone. Several factors can influence the percentage they charge, including the property’s location, value, and market conditions.

In general, homes in desirable locations with high property values tend to have lower commission rates. This is because agents are more likely to compete for these listings, leading to lower fees. Conversely, homes in less desirable locations or with lower values may have higher commission rates as agents may need to work harder to sell them.

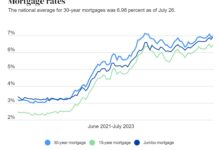

Market Conditions

Market conditions can also impact commission rates. In a hot seller’s market, where homes are selling quickly and for high prices, agents may be able to negotiate lower commission rates. This is because they are more likely to sell the property quickly and easily, requiring less effort on their part.

In a buyer’s market, where homes are taking longer to sell and for lower prices, agents may need to offer higher commission rates to attract sellers. This is because they may have to work harder to sell the property and may need to offer incentives to potential buyers.

Negotiating Commission Rates

Negotiating commission rates is an important aspect of the home buying and selling process. Both buyers and sellers should be aware of their rights and options when it comes to negotiating commissions.

Tips for Buyers

- Research the average commission rates in your area. This will give you a good starting point for negotiations.

- Interview multiple real estate agents and compare their commission rates.

- Be prepared to negotiate. Don’t be afraid to ask for a lower commission rate if you think it’s too high.

- Consider offering a performance-based commission. This means that the agent’s commission will be based on the sale price of your home.

Tips for Sellers

- Be aware of the standard commission rates in your area.

- Negotiate the commission rate with the agent before signing a listing agreement.

- Consider offering a lower commission rate for a longer listing period.

- If you’re selling your home yourself, you may be able to negotiate a lower commission rate with a buyer’s agent.

Average Commission Rates

Understanding average commission rates for different property types and geographic regions is crucial for both buyers and sellers. These rates vary depending on several factors, including the property’s value, location, and the agent’s experience and negotiation skills.

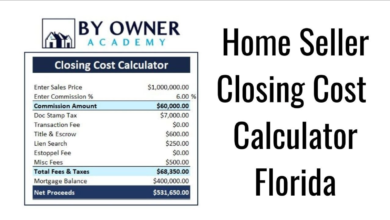

The table below provides an overview of average commission rates in different regions:

Average Commission Rates by Region

| Region | Average Commission Rate |

|---|---|

| United States | 5-6% |

| Canada | 5-7% |

| United Kingdom | 1.5-3% |

| Australia | 2-3% |

| New Zealand | 3-4% |

It’s important to note that these are just averages, and the actual commission rate you pay or receive may vary depending on your specific circumstances. It’s always advisable to negotiate with your agent to determine a fair and reasonable commission rate.

Impact of Technology on Commissions

The advent of technology has had a significant impact on the real estate industry, including the way commissions are structured and negotiated. The rise of discount brokerages and online platforms has led to a decline in traditional commission rates, as these platforms offer lower fees and more flexibility to homebuyers and sellers.

Discount brokerages, such as Redfin and Zillow, typically charge a flat fee for their services, rather than a percentage of the home’s sale price. This can save homebuyers and sellers thousands of dollars in commission costs. Online platforms, such as Opendoor and Offerpad, allow homeowners to sell their homes directly to the company, eliminating the need for a traditional real estate agent and the associated commission fees.

Impact on Real Estate Agents

The rise of technology has also had a significant impact on the role of real estate agents. Traditional agents, who once relied on commissions as their primary source of income, have had to adapt to the changing landscape. Many agents have begun to offer additional services, such as home staging and marketing, to supplement their income.

Others have shifted their focus to higher-priced homes, where they can earn a higher commission.

Future of Commissions

It is difficult to predict the future of commissions in the real estate industry. However, it is clear that technology will continue to play a major role in shaping the way homes are bought and sold. Discount brokerages and online platforms are likely to continue to gain market share, and traditional agents will need to continue to adapt to the changing landscape in order to remain competitive.

Legal and Ethical Considerations

Commission agreements should adhere to legal and ethical standards to ensure fairness and transparency. Understanding these considerations can help avoid disputes and maintain professional integrity.

Best Practices

* Written Agreement: Document all commission terms in a written agreement signed by both parties. This provides clarity and reduces misunderstandings.

Full Disclosure

Disclose all relevant information about the commission structure, including the percentage, calculation method, and payment schedule.

Avoid Conflicts of Interest

Agents should avoid situations where their personal interests may conflict with their duties to their clients.

Ethical Representation

Agents must act in the best interests of their clients and avoid any unethical practices, such as misrepresentation or coercion.

Legal Considerations

* Licensing and Registration: Ensure that agents are licensed and registered in accordance with local laws and regulations.

Antitrust Laws

Commission agreements must not violate antitrust laws that prohibit collusion or price-fixing among competitors.

Consumer Protection Laws

Some jurisdictions have laws protecting consumers from unfair or deceptive practices, which may apply to commission agreements.

Tax Implications

Understand the tax implications of commission income and ensure compliance with relevant tax laws.

Case Studies and Examples

In the real estate industry, commission negotiations are a crucial aspect of closing deals successfully. Here are some real-world examples and case studies to illustrate the dynamics of commission negotiations:

Case Study 1: Negotiation for a Luxury Property

In a highly competitive market, a seller of a luxury property listed their home for $5 million. The seller’s agent initially proposed a 6% commission, which would have resulted in a $300,000 commission. However, after negotiation with the buyer’s agent, they agreed on a commission rate of 5%, resulting in a $250,000 commission.

This negotiation saved the seller $50,000.

Case Study 2: Flat-Fee Commission for a Smaller Home

A seller of a modest home valued at $200,000 was seeking to minimize their expenses. Instead of a percentage-based commission, they negotiated a flat-fee commission of $10,000 with their agent. This flat-fee structure provided the seller with a predictable and lower commission cost compared to a percentage-based commission.

Last Recap

Understanding typical home sales commissions empowers you to approach real estate transactions with confidence. By grasping the various commission structures, negotiating effectively, and considering the impact of technology and legal considerations, you can navigate the home sales process seamlessly, ensuring a smooth and rewarding experience.

Helpful Answers

What are the different types of commission structures?

Common commission structures include flat fees, percentage-based commissions, and tiered commissions. Flat fees involve a fixed amount regardless of the home’s sale price, while percentage-based commissions are a percentage of the sale price. Tiered commissions offer different rates for different price ranges.

How do factors like location and market conditions influence commission rates?

Location, property value, and market conditions significantly impact commission rates. Homes in competitive markets or desirable locations tend to have higher commission rates, while lower-priced homes or those in less competitive markets may have lower rates.

What strategies can buyers and sellers use to negotiate commission rates?

Negotiating commission rates involves research, preparation, and effective communication. Buyers and sellers should compare rates from multiple agents, consider the value of the services provided, and be prepared to justify their proposed rates.

What are some hidden costs and fees associated with home sales commissions?

In addition to the commission, buyers and sellers may encounter closing costs, title insurance, inspection fees, and other expenses. Understanding these costs upfront helps avoid surprises and ensures a smooth closing process.