Housing Market Forecast For 2024: What To Expect

In the ever-evolving real estate landscape, it’s imperative to stay abreast of market trends and predictions. As we approach 2024, the housing market is poised for significant shifts, influenced by a confluence of economic, demographic, and technological factors. This forecast delves into the intricate dynamics that will shape the housing market in the coming year, providing valuable insights for buyers, sellers, investors, and industry professionals alike.

From the impact of rising interest rates and inflation to the influence of technology and sustainability, this comprehensive analysis unravels the complexities of the housing market. We explore regional variations, affordability challenges, and the evolving investment landscape, empowering you to make informed decisions in this dynamic market.

Market Trends

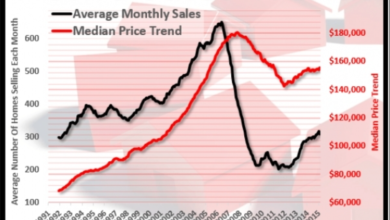

The housing market has historically experienced cycles of booms and busts, influenced by economic factors, government policies, and demographic shifts. In recent years, the market has been characterized by rising home prices, low inventory, and high demand. These trends have been driven by factors such as low interest rates, strong economic growth, and a growing population.

Factors Influencing Current Market Conditions

* Low interest rates: Interest rates have remained low in recent years, making it more affordable for buyers to finance their homes.

Strong economic growth

The economy has been growing steadily, leading to increased job creation and wage growth. This has made it easier for buyers to qualify for mortgages and afford monthly payments.

Growing population

The population has been growing, which has increased demand for housing. This has led to a decrease in inventory and an increase in home prices.

Economic Outlook

The economic outlook for 2024 has a significant bearing on the housing market. Economic growth, interest rates, and inflation are key factors that will shape the housing market in the coming year.Economic forecasts for 2024 predict moderate growth, with the global economy expected to expand by around 3.5%. This growth will be supported by continued recovery from the COVID-19 pandemic, increased consumer spending, and government stimulus measures.

However, geopolitical uncertainties, supply chain disruptions, and rising inflation pose risks to the economic outlook.

Interest Rate Trends

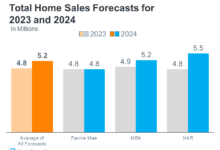

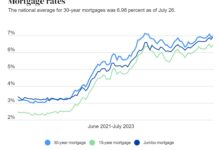

Interest rates are a crucial factor in the housing market as they influence mortgage rates. In 2023, central banks around the world raised interest rates aggressively to combat rising inflation. This trend is expected to continue in 2024, albeit at a slower pace.

Higher interest rates make mortgages more expensive, which can reduce demand for housing and slow down price growth.

Inflation

Inflation has been a major concern in 2023 and is likely to remain elevated in 2024. Rising inflation erodes the purchasing power of consumers, making it more difficult for them to afford housing. High inflation can also lead to higher construction costs, further contributing to affordability challenges.

Supply and Demand Dynamics

The supply and demand dynamics of the housing market play a crucial role in determining price trends. In recent years, the market has experienced a significant imbalance between supply and demand, with a shortage of available homes leading to rising prices.Inventory

levels remain low, with the number of homes for sale well below historical averages. This scarcity is partly due to a slowdown in new home construction during the pandemic, which has limited the supply of new properties entering the market.

Additionally, homeowners are increasingly reluctant to sell their properties, as they are hesitant to give up their current low mortgage rates and face the higher costs associated with purchasing a new home.The demand for housing, on the other hand, continues to grow.

Population growth and migration patterns are driving up demand, particularly in desirable urban areas and regions with strong job markets. As more people move to these areas, the competition for available homes intensifies, further pushing up prices.

Impact of New Home Construction

New home construction is a key factor in addressing the supply shortage. However, the pace of construction has been constrained by various factors, including labor shortages, supply chain disruptions, and rising material costs. As a result, the number of new homes being built has not kept pace with the growing demand.The

government and industry stakeholders are exploring initiatives to incentivize new home construction and increase the supply of affordable housing. These measures may include tax breaks for developers, streamlined permitting processes, and partnerships with non-profit organizations to provide affordable housing options.

Influence of Population Growth and Migration Patterns

Population growth and migration patterns have a significant impact on housing demand. Areas experiencing population growth, such as major cities and sunbelt states, typically see increased demand for housing, leading to higher prices.Migration patterns also play a role in shaping housing markets.

For example, the influx of remote workers during the pandemic has boosted housing demand in smaller cities and rural areas, where housing prices have risen in response to the increased demand.Understanding the supply and demand dynamics of the housing market is essential for making informed decisions about buying, selling, or investing in real estate.

By monitoring inventory levels, analyzing new home construction trends, and considering population growth and migration patterns, individuals can gain valuable insights into the market and make strategic choices that align with their financial goals.

Regional Variations

Regional housing markets exhibit diverse trends and dynamics. Understanding these variations is crucial for investors and homebuyers alike.Factors driving regional variations include economic growth, job market conditions, population trends, and local regulations. Coastal regions and metropolitan areas often experience higher demand and prices due to their desirability and economic opportunities.

In contrast, rural areas and regions with declining populations may face challenges in maintaining housing values.

Key Regional Housing Markets

West Coast:

- Strong economic growth and tech industry

- High demand and limited inventory

- Rising prices, particularly in urban centers like San Francisco and Los Angeles

East Coast:

- Stable economic growth and diverse industries

- High demand in major cities like New York and Boston

- Competitive market with both high prices and inventory

Midwest:

- Moderate economic growth and steady population

- Affordable housing options

- Stable market with gradual price appreciation

South:

- Rapid population growth and economic expansion

- Strong demand in Sun Belt cities like Atlanta and Dallas

- Affordable housing relative to other regions

Sun Belt:

- Growing population and economic activity

- High demand and rising prices in desirable areas

- Diverse market with both affordable and luxury options

Affordability and Homeownership

Affordability remains a key concern in the housing market, with rising home prices and stagnant wages making it challenging for many to purchase a home. The affordability crisis is particularly acute in certain regions and for specific demographics, such as first-time homebuyers and low-income households.

Government Policies and Programs

Governments at various levels have implemented policies and programs to address affordability concerns and promote homeownership. These include:

Down payment assistance programs

Provide financial assistance to first-time homebuyers with down payments.

Low-interest mortgages

Offer mortgages with below-market interest rates, making monthly payments more affordable.

Rent-to-own programs

Allow tenants to gradually purchase their rental property over time.

Challenges and Opportunities for First-Time Homebuyers

First-time homebuyers face unique challenges, including:

Saving for a down payment

The down payment is often the most significant barrier to homeownership.

Qualifying for a mortgage

Lenders have strict requirements for credit scores, debt-to-income ratios, and other factors.

Navigating the competitive market

In many areas, homes receive multiple offers, making it difficult for first-time buyers to compete.Despite these challenges, there are also opportunities for first-time homebuyers:

Government programs

As mentioned earlier, government programs can provide financial assistance and support.

Downsizing or starting with a smaller home

Consider purchasing a smaller home or townhouse as a stepping stone to a larger property in the future.

Research and explore different neighborhoods

Explore neighborhoods with lower home prices or consider suburbs or exurbs for more affordability.

Technology and Innovation

Technology has revolutionized the housing market, making the process of buying and selling homes more efficient, convenient, and transparent.From virtual tours and online listings to artificial intelligence (AI)-powered property recommendations, technology is transforming the way we interact with the housing market.

Virtual Reality (VR) and Augmented Reality (AR)

VR and AR allow buyers to experience homes remotely, providing a more immersive and realistic view of properties. This technology enables buyers to explore homes from anywhere, at any time, and make more informed decisions.

Sustainability and Green Building

The demand for sustainable and environmentally friendly homes is on the rise, driven by increasing awareness of climate change and the desire for healthier living spaces. According to a survey by the National Association of Home Builders, 80% of homebuyers are willing to pay more for a home with green features.

Energy Efficiency

Energy-efficient homes use less energy to heat, cool, and power, reducing utility bills and carbon emissions. The use of insulation, efficient appliances, and renewable energy sources like solar panels has become increasingly common.

Environmental Impact

Green building practices minimize the environmental impact of homes by using sustainable materials, reducing waste, and conserving water. This includes using recycled materials, installing low-flow fixtures, and designing homes to maximize natural light and ventilation.

Home Value and Marketability

Green building practices can increase home values and marketability. Studies have shown that homes with green features sell faster and for a higher price than comparable homes without these features. This is because green homes are seen as more desirable, healthier, and more cost-effective in the long run.

Investment and Rental Market

The housing market offers investment opportunities for individuals and companies seeking to generate income or build wealth. Rental properties have consistently been a popular investment choice, providing a steady stream of rental income and potential appreciation in value.

Rental Market Trends

The rental market is influenced by several factors, including economic conditions, demographics, and government regulations. In recent years, rental demand has been driven by factors such as rising home prices, increasing urbanization, and a growing population of renters.The supply of rental units has also played a significant role in shaping the market.

In many areas, there has been a shortage of affordable rental housing, leading to higher rents and increased competition among tenants.

Investment Potential

Investing in rental properties can offer several potential benefits, including:

- Regular income from rent payments

- Potential for appreciation in property value

- Tax advantages, such as deductions for mortgage interest and property taxes

However, it’s important to consider the risks associated with rental property investment, such as:

- Vacancy periods

- Maintenance and repair costs

- Legal issues with tenants

To succeed in the rental market, investors should carefully research the local market, understand the legal and financial implications, and develop a sound investment strategy.

Closing Summary

As we navigate the uncharted waters of 2024, the housing market presents both challenges and opportunities. By understanding the intricate interplay of economic, social, and technological forces, we can anticipate market movements and position ourselves for success. Whether you’re a seasoned investor or a first-time homebuyer, this forecast provides invaluable guidance, empowering you to make informed decisions and capitalize on the evolving landscape of the housing market.

Answers to Common Questions

What are the key factors influencing the housing market in 2024?

Economic outlook, interest rate trends, inflation, supply and demand dynamics, regional variations, affordability, technology, sustainability, and investment trends are among the primary factors shaping the housing market in 2024.

How will rising interest rates impact the housing market?

Rising interest rates generally lead to higher mortgage rates, which can reduce affordability and slow down the pace of home sales. However, the impact may vary depending on regional market conditions and individual circumstances.

What are the affordability challenges facing homebuyers in 2024?

Affordability remains a significant challenge, particularly for first-time homebuyers. Rising home prices, coupled with higher interest rates and inflation, can make it difficult for many to qualify for a mortgage or find a home within their budget.

How is technology transforming the housing market?

Technology is revolutionizing the home buying and selling process, from virtual tours and augmented reality to artificial intelligence-powered property valuations. These advancements enhance convenience, transparency, and efficiency for both buyers and sellers.

What is the outlook for the rental market in 2024?

The rental market is expected to remain competitive in 2024, with high demand and limited supply in many areas. This may lead to continued rent increases and challenges for renters seeking affordable housing options.