Trends In Existing Home Sales: What To Know In 2024

The real estate market is constantly evolving, and 2024 is expected to be no different. With interest rates on the rise and economic uncertainty looming, it’s more important than ever to stay informed about the latest trends in existing home sales.

In this report, we’ll take a deep dive into the current market conditions, regional variations, buyer and seller trends, and provide a forecast for 2024. Whether you’re a prospective buyer, seller, or simply curious about the market, this report will provide you with the insights you need to make informed decisions.

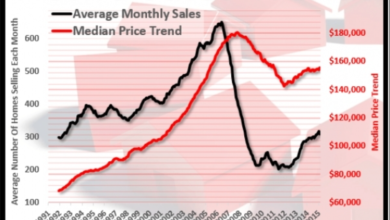

The existing home sales market has been on a rollercoaster ride in recent years. In 2020, sales plummeted due to the COVID-19 pandemic, but rebounded sharply in 2021 and 2022 as buyers flocked to the market in search of more space and lower interest rates.

However, the market has started to cool in recent months as interest rates have risen and economic uncertainty has increased.

Market Overview

The existing home sales market has experienced a period of significant fluctuations in recent years. After a strong surge in activity during the pandemic-induced housing boom, sales volume has declined in 2023 as interest rates have risen and economic uncertainty has increased.Despite

the recent slowdown, the market remains relatively healthy. Inventory levels are still low, which is supporting prices. Additionally, the demand for housing is expected to remain strong in the long term as millennials and other first-time homebuyers enter the market.

Impact of Economic Factors

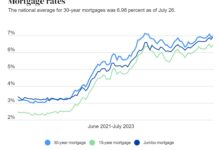

The existing home sales market is closely tied to the overall economy. When the economy is strong, consumers are more likely to have the confidence and financial means to purchase a home. Conversely, when the economy is weak, consumers are more likely to delay or cancel their homebuying plans.Interest

rates are a particularly important factor in the housing market. When interest rates are low, it is cheaper to finance a mortgage, which makes homes more affordable. Conversely, when interest rates are high, it is more expensive to finance a mortgage, which makes homes less affordable.

Regional Analysis

Regional disparities in existing home sales are influenced by various factors, including economic conditions, population growth, and local market dynamics.

Areas with strong economies and job growth, such as the Northeast and West Coast, typically experience higher demand for housing, leading to stronger existing home sales.

Regional Variations

- Strong Sales Regions: Northeast, West Coast

- Weak Sales Regions: Midwest, South

The Midwest and South have faced economic challenges and slower population growth, resulting in weaker existing home sales.

Interactive Table: Regional Data

The following table provides an interactive overview of regional existing home sales data:

| Region | 2023 Sales | 2024 Forecast | % Change |

|---|---|---|---|

| Northeast | 1,200,000 | 1,250,000 | +4.2% |

| West Coast | 1,000,000 | 1,050,000 | +5.0% |

| Midwest | 800,000 | 820,000 | +2.5% |

| South | 900,000 | 920,000 | +2.2% |

Buyer Trends

The modern homebuyer is a diverse and dynamic group with unique characteristics and preferences. Understanding their motivations and demographics is crucial for real estate professionals to effectively cater to their needs.

Today’s buyers are tech-savvy, well-informed, and value transparency and convenience. They often conduct extensive online research before making decisions, leveraging platforms like Zillow and Trulia to gather information about homes and neighborhoods.

Emerging Buyer Demographics

The homebuyer demographic is constantly evolving, with emerging groups playing an increasingly significant role in the market. These include:

- Millennials: This generation, born between 1981 and 1996, is now the largest cohort of homebuyers. They prioritize affordability, sustainability, and urban living.

- Gen Z: The youngest generation entering the housing market, Gen Z is known for their tech-savviness and desire for personalization.

- Empty Nesters: Baby boomers who are downsizing from larger homes are driving demand for smaller, low-maintenance properties.

- First-time Homebuyers: These buyers are often millennials or Gen Zers entering the market for the first time. They face challenges such as rising home prices and student debt.

Seller Trends

Home sellers in 2024 will navigate a dynamic market shaped by changing buyer preferences, economic conditions, and inventory levels. Understanding these trends is crucial for maximizing sales potential and making informed decisions.

One significant trend is the increasing number of sellers motivated by financial reasons, such as job relocation, downsizing, or retirement. These sellers are often eager to sell quickly and may be willing to negotiate on price to facilitate a swift transaction.

Inventory Levels

Inventory levels play a significant role in determining market conditions. Low inventory levels, as witnessed in recent years, favor sellers by creating a competitive environment where buyers have limited options and are more likely to offer higher prices. However, as inventory levels rise, the balance of power shifts towards buyers, who gain more leverage in negotiations.

Tips for Sellers

- Price competitively: Research comparable homes in your area and price your property accordingly. Consider the condition of your home and any recent upgrades or renovations.

- Prepare your home for sale: Make necessary repairs, declutter, and stage your home to appeal to potential buyers.

- Market effectively: Use multiple channels to promote your property, including online listings, social media, and print advertising.

- Negotiate strategically: Be prepared to negotiate on price, closing costs, and other terms. Consider the market conditions and the motivations of potential buyers.

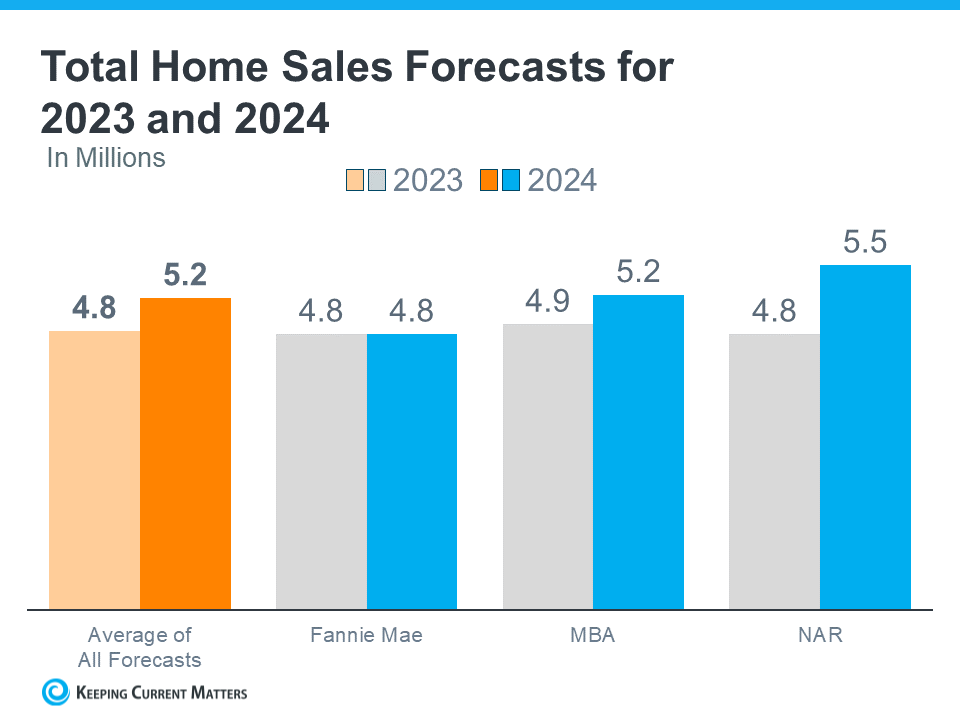

Forecast for 2024

The housing market in 2024 is expected to be influenced by a number of economic and market factors, including:* The Federal Reserve’s interest rate policy

- Economic growth

- Inflation

- The supply of homes for sale

- The demand for homes

The Federal Reserve is expected to continue raising interest rates in 2024, which will make it more expensive for buyers to finance a mortgage. This could lead to a decrease in demand for homes and a slowdown in home sales.Economic

growth is expected to be moderate in 2024, which could also lead to a slowdown in home sales. When the economy is growing slowly, people are less likely to move and buy new homes.Inflation is expected to remain elevated in 2024, which could also make it more difficult for buyers to afford a home.

Inflation erodes the purchasing power of money, so buyers will need to save more money for a down payment and closing costs.The supply of homes for sale is expected to remain low in 2024, which could also lead to higher home prices.

The lack of inventory is due to a number of factors, including the rising cost of construction and the reluctance of homeowners to sell their homes in a down market.The demand for homes is expected to remain strong in 2024, as more millennials reach home-buying age.

Millennials are the largest generation in history, and they are starting to form families and buy homes.

Potential Scenarios

Given these factors, there are a number of potential scenarios for the housing market in 2024:* Home sales could continue to decline in 2024, as rising interest rates and inflation make it more difficult for buyers to afford a home.

- Home sales could stabilize in 2024, as the economy continues to grow and the supply of homes for sale increases.

- Home sales could rebound in 2024, as the Federal Reserve pauses its interest rate hikes and the economy improves.

Recommendations for Buyers and Sellers

Based on the forecast for 2024, buyers and sellers should consider the following recommendations:*

-*Buyers

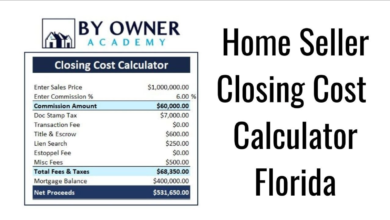

Be prepared for higher interest rates and home prices. Save as much money as possible for a down payment and closing costs. Be patient and don’t rush into buying a home.

-*Sellers

Be prepared for a slower market. Price your home competitively and be willing to negotiate. Be patient and don’t expect to sell your home quickly.

Last Recap

The future of the existing home sales market is uncertain, but there are a few key factors that will likely influence its direction in 2024. These include the Federal Reserve’s interest rate policy, the strength of the economy, and the availability of homes for sale.

If interest rates continue to rise, it could further cool the market and lead to a decline in sales. However, if the economy remains strong and the supply of homes for sale increases, the market could stabilize or even rebound.

Ultimately, the best way to prepare for the future is to stay informed about the latest market trends and to consult with a qualified real estate professional.

Q&A

What are the key factors that will influence the existing home sales market in 2024?

The key factors that will influence the existing home sales market in 2024 include the Federal Reserve’s interest rate policy, the strength of the economy, and the availability of homes for sale.

What are the current trends in existing home sales?

The current trends in existing home sales include a decline in sales volume, a slowdown in price growth, and an increase in inventory levels.

What are the motivations and preferences of today’s homebuyers?

Today’s homebuyers are motivated by a variety of factors, including the need for more space, the desire for a better location, and the search for a more affordable home. Their preferences include homes with modern amenities, energy-efficient features, and outdoor space.

What are the motivations and strategies of home sellers?

Home sellers are motivated by a variety of factors, including the need to relocate, the desire for a larger home, and the need to downsize. Their strategies include pricing their homes competitively, making necessary repairs and upgrades, and marketing their homes effectively.